raleigh nc sales tax calculator

Real property tax on median home. The state sales tax rate in North Carolina is 4750.

North Carolina Online Sales Tax Raleigh Accounting Firm

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Carolina local counties cities and special taxation districts.

. Sales Tax State Local Sales Tax on Food. Sales Tax State Local Sales Tax on Food. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the states tax structure.

The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive income tax system with rates ranging from 6 to 775. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales.

North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Sales Tax State Local Sales Tax on Food.

The City is required to pay North Carolina state and local sales taxes. West Raleigh NC Sales Tax Rate. The December 2020 total local sales tax rate was also 7250.

Raleigh North Carolina and Winston-Salem North Carolina. The 725 sales tax rate in Raleigh consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. The information included on this website is to be used only as a guide.

You can print a 725 sales tax table hereFor tax rates in other cities see North Carolina sales taxes by city and county. Ad Find Out Sales Tax Rates For Free. 077 average effective rate.

PO Box 25000 Raleigh NC 27640-0640. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Raleigh NC.

Thank you for printing this page from the City of Raleighs Official Website wwwraleighncgov 09282021 1159 am Sales Tax. Raleigh Nc Sales Tax Calculator. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

3610 cents per gallon both of regular gasoline and diesel. The current total local sales tax rate in West Raleigh NC is 7250The December 2020 total local sales tax rate was also 7250. Real property tax on median home.

The information included on this website is to be used only as a guide. The act went into full effect in 2014 but before then North Carolina had a three. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

With local taxes the total sales tax rate is between 6750 and 7500. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Our purchase orders estimate these taxes.

Fast Easy Tax Solutions. Real property tax on median home. Real property tax on median home.

The North Carolina NC state sales tax rate is currently 475. Sales Tax State Local Sales Tax on Food. 2022 Cost of Living Calculator for Taxes.

Sales and Use Tax Sales and Use Tax. Real property tax on median home. Real property tax on median home.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. The current total local sales tax rate in Raleigh NC is 7250. 2022 Cost of Living Calculator for Taxes.

North Carolina Department of Revenue. Sales Tax State Local Sales Tax on Food. December 30 2021 natural anti inflammatory recipes.

There is no applicable city tax. North Carolina has recent rate changes Fri Jan 01 2021. With local taxes the total sales tax rate is between 6750 and 7500.

However all applicable taxes should be included on your invoices. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales. It is not intended to cover all provisions of the law or every taxpayers specific circumstances.

Raleigh North Carolina and Durham North Carolina. Sales tax calculator raleigh nc. It is not intended to cover all provisions of the law or every taxpayers specific circumstances.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Sales Tax State Local Sales Tax on Food.

North Carolina Sales Tax Guide And Calculator 2022 Taxjar

Fact Check How Does Biden S Corporate Tax Rate Compare To Other Countries Wral Com

Sales Tax Calculator Free Tax Me Shopping Checkout Coupon And Discount Helper Helper Discount Coupon Finance Tax Free Sales Tax Coupons

The 5 Best Assisted Living Facilities In Southern Pines Nc For 2022

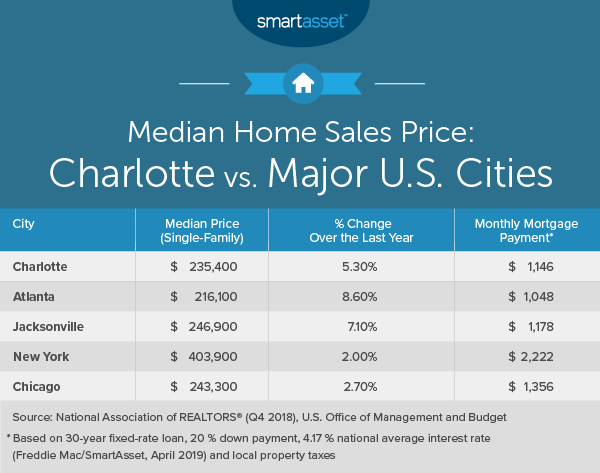

The Cost Of Living In Charlotte North Carolina Smartasset

North Carolina Sales And Use Tax Audit Guide

North Carolina S Transition To A Low Tax State

Wake County Nc Property Tax Calculator Smartasset

North Carolina Sales Tax Small Business Guide Truic

Taxes Wake County Economic Development

State Corporate Income Tax Rates And Brackets Tax Foundation

New Report Income Tax Amendment Would Put Schools Transportation Public Health At Risk Nc Policy Watch

28214 Sales Tax Rate Nc Sales Taxes By Zip

Wake County North Carolina Property Tax Rates 2020 Tax Year

West Virginia Property Tax Calculator Smartasset

The Ultimate Guide To North Carolina Property Taxes

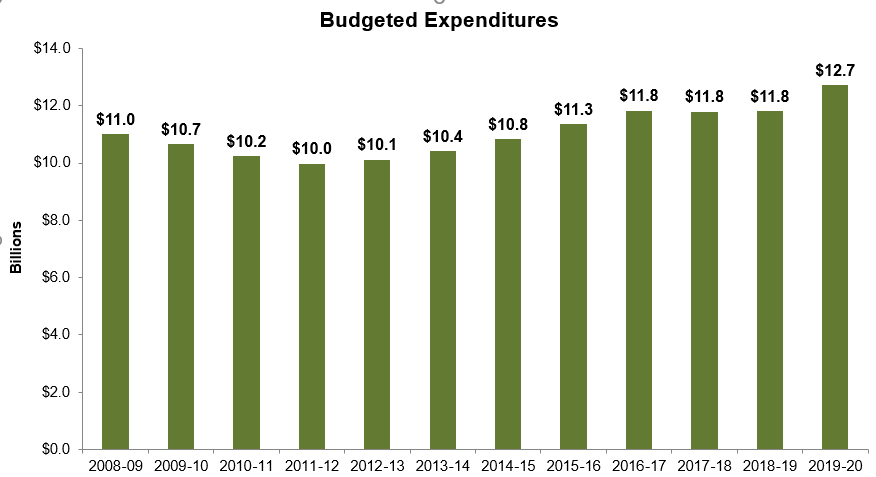

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom